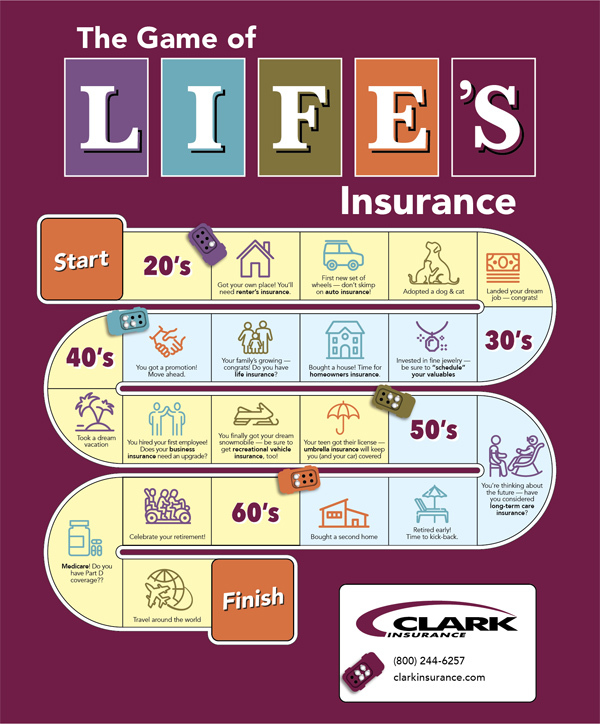

24 Nov In the Game of Life, Don’t Go Without Insurance

Remember the ‘Game of Life’ board game? The one you probably played in your living room as a little kid? The goal was to collect points (and avoid losses) by hitting certain life milestones (like going to college, buying a house, and having kids) while steering clear of others (think: car accidents or break-ins).

While navigating the ups and downs of the real game of life isn’t quite as simple as spinning a wheel and following a path set forth by the makers of a board game, throughout our lives there are certain milestones that require us to think about protecting ourselves, our loved ones, and our assets.

From getting the keys to your first apartment (hello, renter’s insurance) to the keys to your first car (auto insurance!) to the start of retirement (time to consider long-term care insurance and medicare), the stops along the way may vary or happen at different times for different people, but the one thing that unites us is the need for protection.

Insurance isn’t just a way to shelter ourselves and our assets from loss, finding the right insurance – and insurance provider – can be a blanket of protection for our loved ones and those around us.

To put it simply, insurance is protection against life’s unknowns. But there are so many different kinds of insurance out there, when should you be thinking about which type of insurance? To make it easy, we’ve laid them all out for you – from moving out on your own to your kid getting their driver’s license.

Ready to get started? Pick your player, and let’s get moving.

20s:

You’ve finally taken that big step, moved out of your parents’ home and gotten your own apartment—what do you do first? If you’re renting an apartment (or a house), renter’s insurance should be at the top of your list.

Overflowing bathtubs, fire, water damage, theft—these are all things that could happen to a renter. While your landlord’s insurance will probably cover the structure of the home, it likely won’t cover any of your stuff if it gets ruined or stolen. Total bummer.

Ready for the good news? Renter’s insurance is usually VERY inexpensive (like, less than you spend on caffeine in a month), and it’s simple to get. Ready to check it off your list? We thought so! Tap here to read more about renter’s insurance.

Now that all your “stuff” is secure, it’s time to think about your car. If you’ve been on your parent’s car insurance until now, you may want to consider making the switch. Sometimes it’s actually cheaper to get your own policy, especially if your parents have, err, newer cars than you. Here are 6 Ways to Decrease Your Auto Premium.

30s:

After the rollercoaster of the 20s, many find a bit more stability as they enter their 30s. If you’ve found “The One” and will be getting engaged and married, or choose to invest in fine jewelry for yourself, insurance for scheduled items or a jewelry rider is super important. Here are 3 Benefits for Scheduling Jewelry.

You may also be thinking about purchasing your first home, in which case homeowners insurance is an imperative. Be sure to check out 6 Things Most Home Insurance Policies Are Missing to learn more. And if you’ll be adding to your family, a good life insurance policy can provide a blanket of protection for your family against life’s unknowns.

40s:

As you enter your 40s, you may be looking into investment properties or even buying a second home. You’ll want to keep your growing assets protected in the event of a major claim by looking into umbrella insurance. And as you become more established in your career, you may be thinking about starting your own business. For that you’ll need strong business insurance coverage to protect yourself and any employees you hire to support your business.

And when that business (or career) becomes wildly successful, you may find yourself enjoying your free time on your new jet-ski (or snowmobile if you’re in New England…). Who knows, it may finally be time to purchase that dream boat or RV. Hey, you only live once! But before you take to the water or set off on that long awaited cross country roadtrip, you’ll need to look into recreational vehicle insurance to protect your purchase.

50s:

Entering your nifty fifties is a time for celebration—you’ve made it this far and retirement is in view! Soon, it’ll be time to kick back, relax, and let the rest of the world worry about getting to work. But before you retire, you’ll want to think about long-term care coverage. Long-term care is certainly not what any of us want to have to think about for ourselves, but it can be a vital lifeline for ourselves and our families as we grow older. Tap here to learn more.

If you’ve had children, your 50s is when you’ll be witnessing some new milestones for them, too. They may even have their license now! As your children enter their teens and hit the road, you’ll want to confirm you have umbrella insurance to ensure their safety. And of course, you’ll want to impart all the insurance knowledge you’ve gained over the years to ensure they’re covered for all the milestones that lie ahead of them, as they begin their own game of life.

60s:

You’ve just retired—now what? Travel the world? Take a cross-country trip with the grandkids? Before you embark on your bucket list, you’ll want to ensure you’re signed up for Medicare, an essential coverage program for those over 65. Not only that, you’ll want to be fluent in the different parts of the Medicare coverage program, especially Part D, which is coverage for your prescriptions. Understanding your coverage options and knowing what they mean is a big step in the Medicare process—but don’t worry, we’re here to help!

If you’re not already thinking about long-term care coverage, now is a great time to consider it. After all, it’s much easier to kick back and relax when you have the peace of mind of having all your insurance coverage needs sorted out!